UX/UI Design, Branding

Optimising for Neurodivergence

Inclusive onboarding built on an agile, responsive framework

A pre-seed fintech startup wanted to improve their mobile banking strategy by leveraging the newly implemented EU Accessibility Act guidelines. Through extensive research on our user group and their pain points, I worked with the team to develop an inclusive strategy that met both business goals and user needs. Through a personalised onboarding flow, the app achieved a significant increase in signups, a sharp rise in customer confidence, and reduced task completion time.

Solution

Inclusive banking for neurodivergent savers.

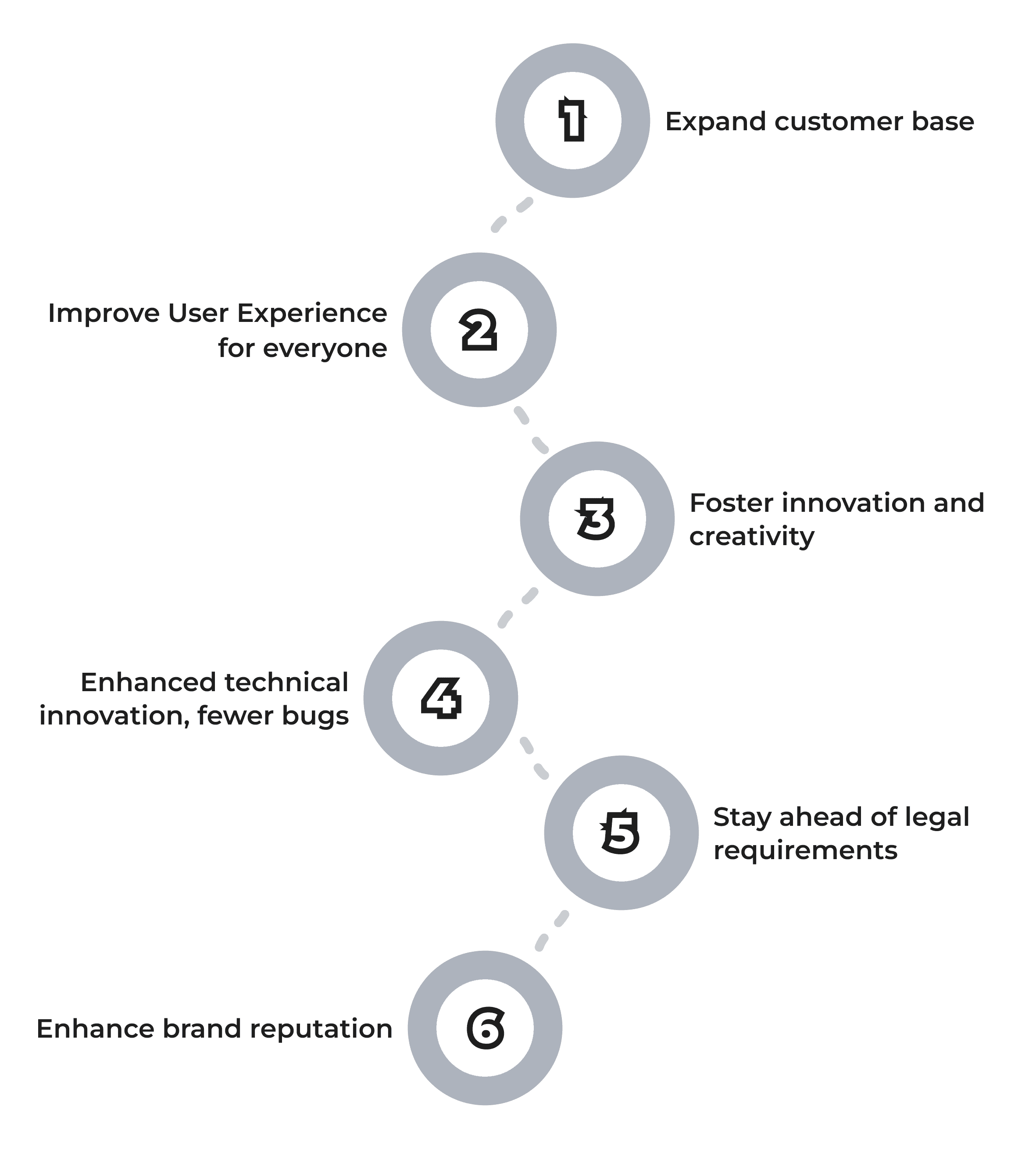

With a user-first approach that adheres to the new EU Accessibility Act, we reduce costs, increase revenue, grow the user base, minimise risks and improve our standing in new markets.

CHALLENGING OLD ASSUMPTIONS

Inclusivity is not an edge case.

Inclusive design is not just a moral imperative; it’s a strategic advantage that can drive innovation, customer loyalty, and business growth. By focusing on neurodivergent users, I argued that we could create a more inclusive, accessible product that meets the needs of a broader audience, ultimately benefiting both the users and the business.

ONLINE RESEARCH

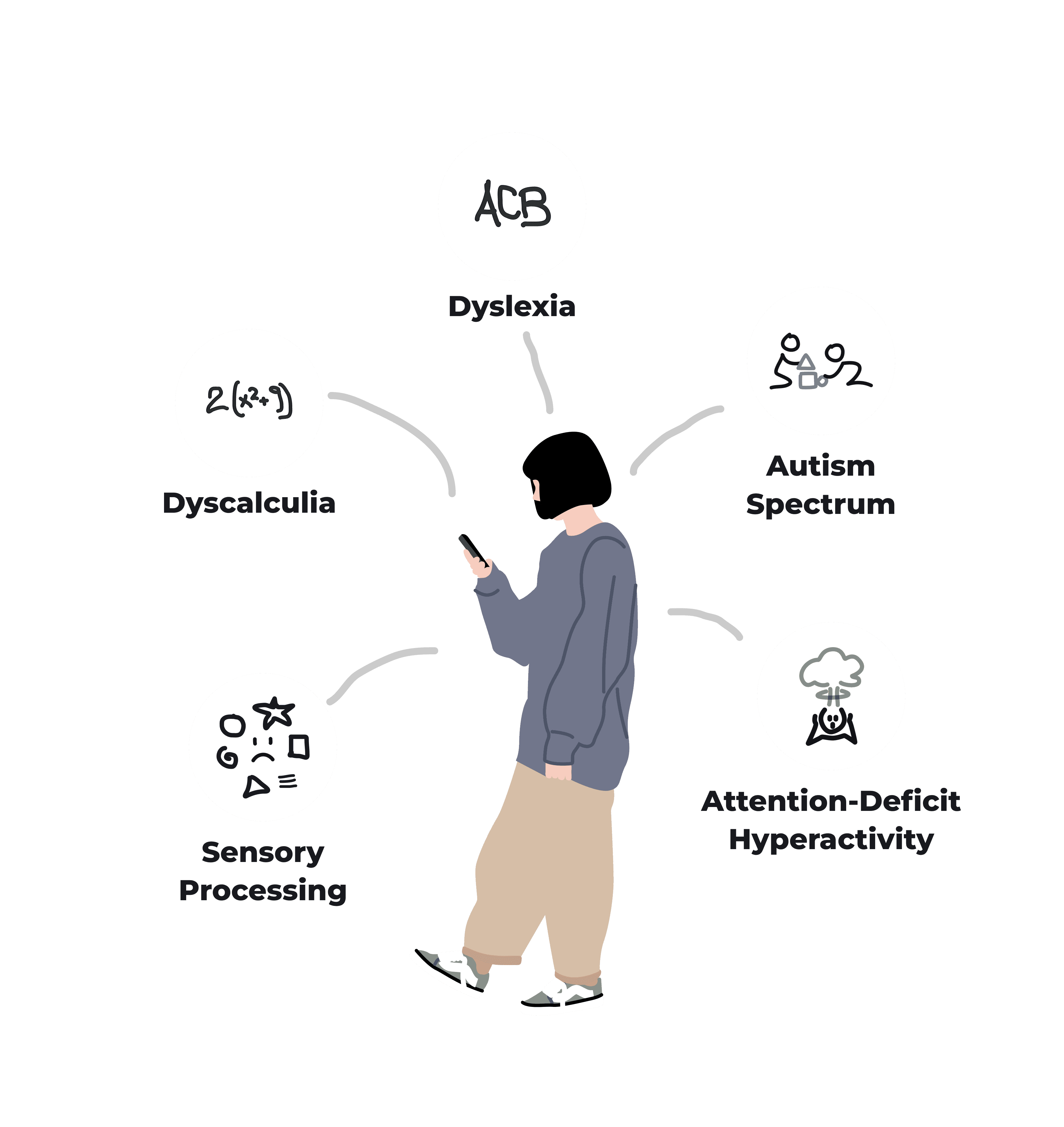

Identifying and pitching neurodivergence to stakeholders.

If we wanted to distinguish our product, we needed to narrow our audience. I identified neurodivergence as an important subgroup because it not only meets business goals, we are designing an inclusive approach that doesn't yet have a large product base.

“Nearly 15% of the general population is considered neurodiverse, yet only half of this group is aware of it."

(World Economic Forum, 2022)

RESEARCH FINDINGS

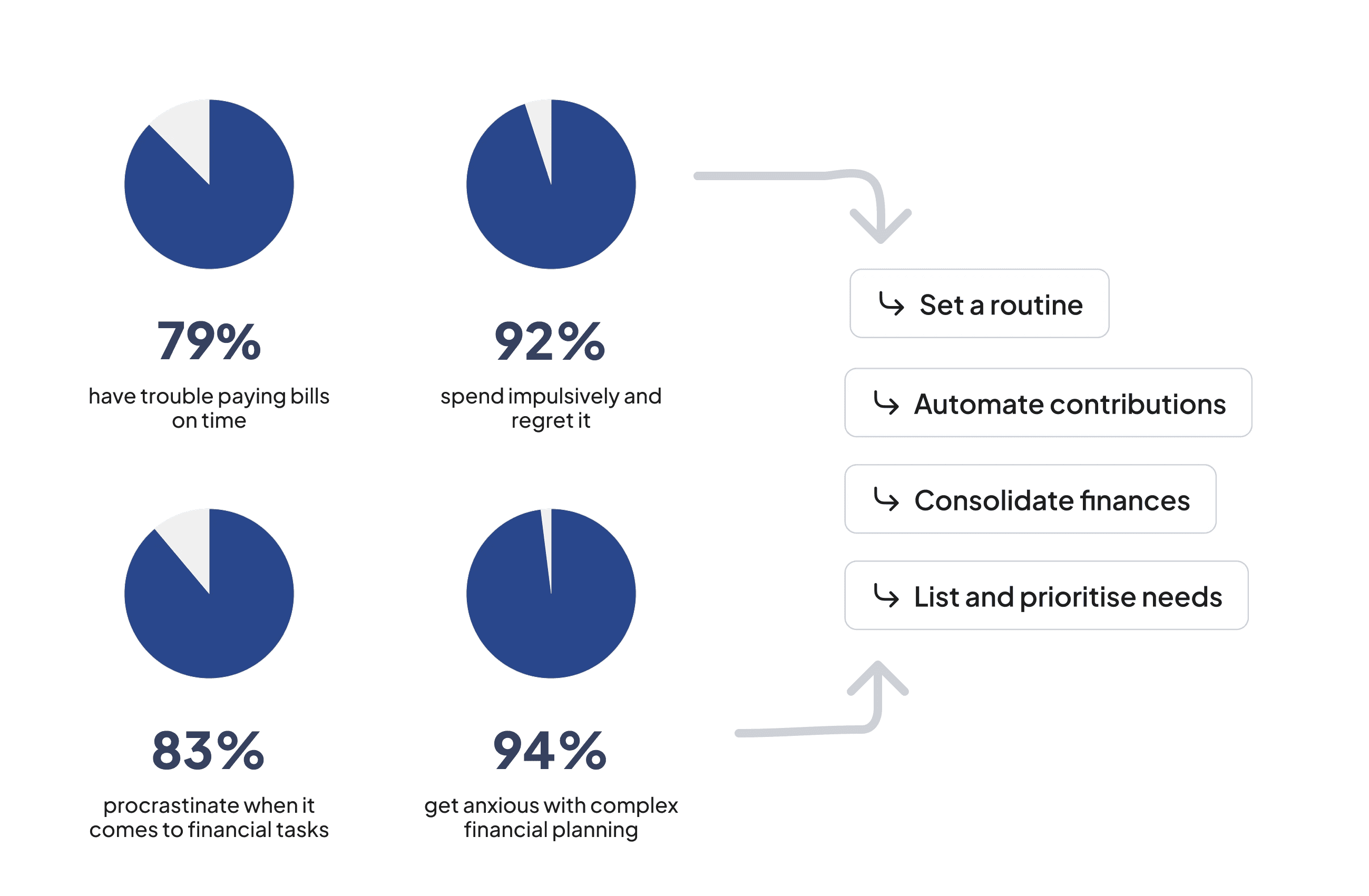

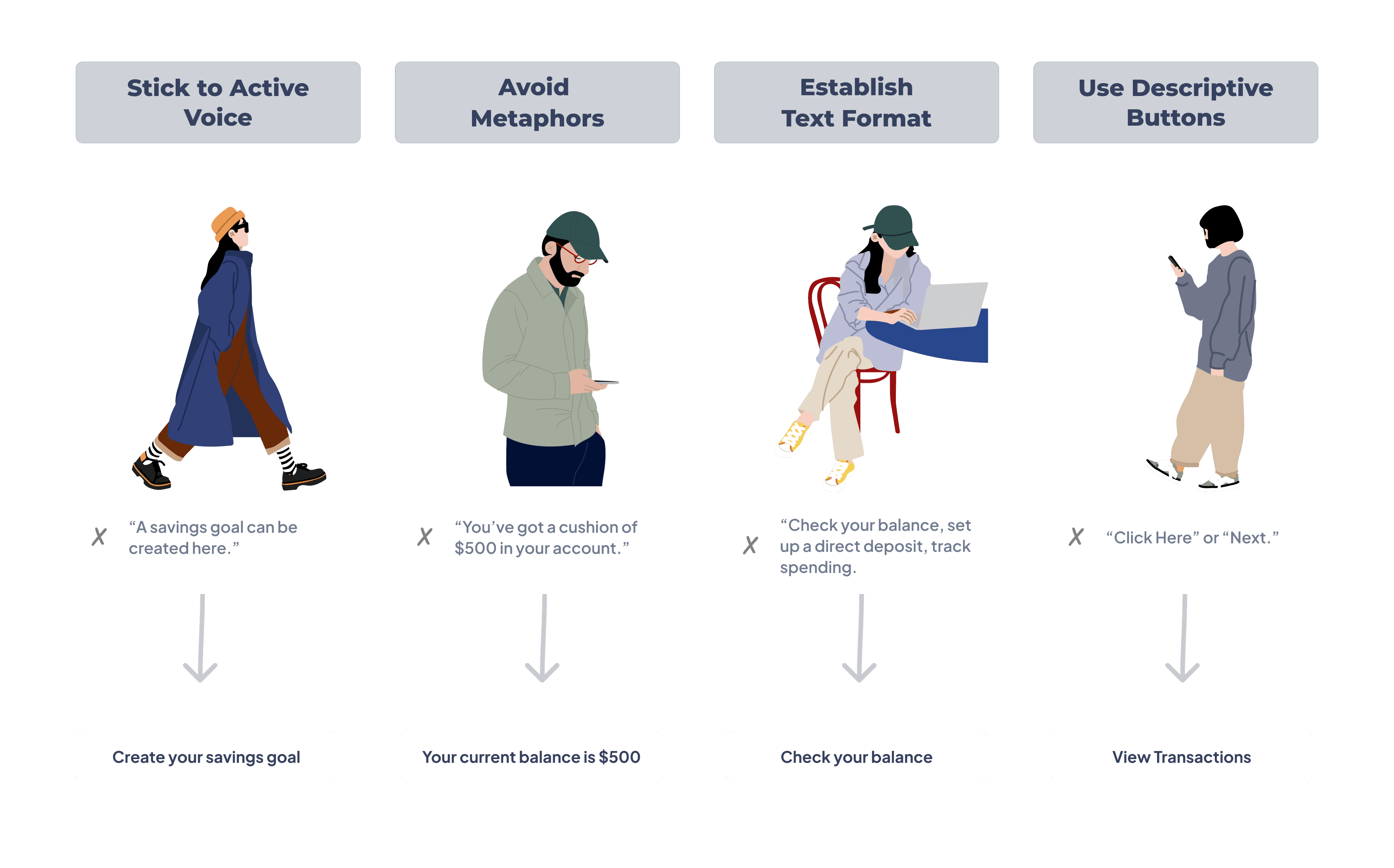

The key is simple and clear communication, in all forms.

Neurodiverse user groups tend to have similar difficulties to everybody else, but in different ways. Some may have trouble with ‘future thinking,’ trouble shooting about why and how they should be putting money in savings.

CONVINCING STAKEHOLDERS

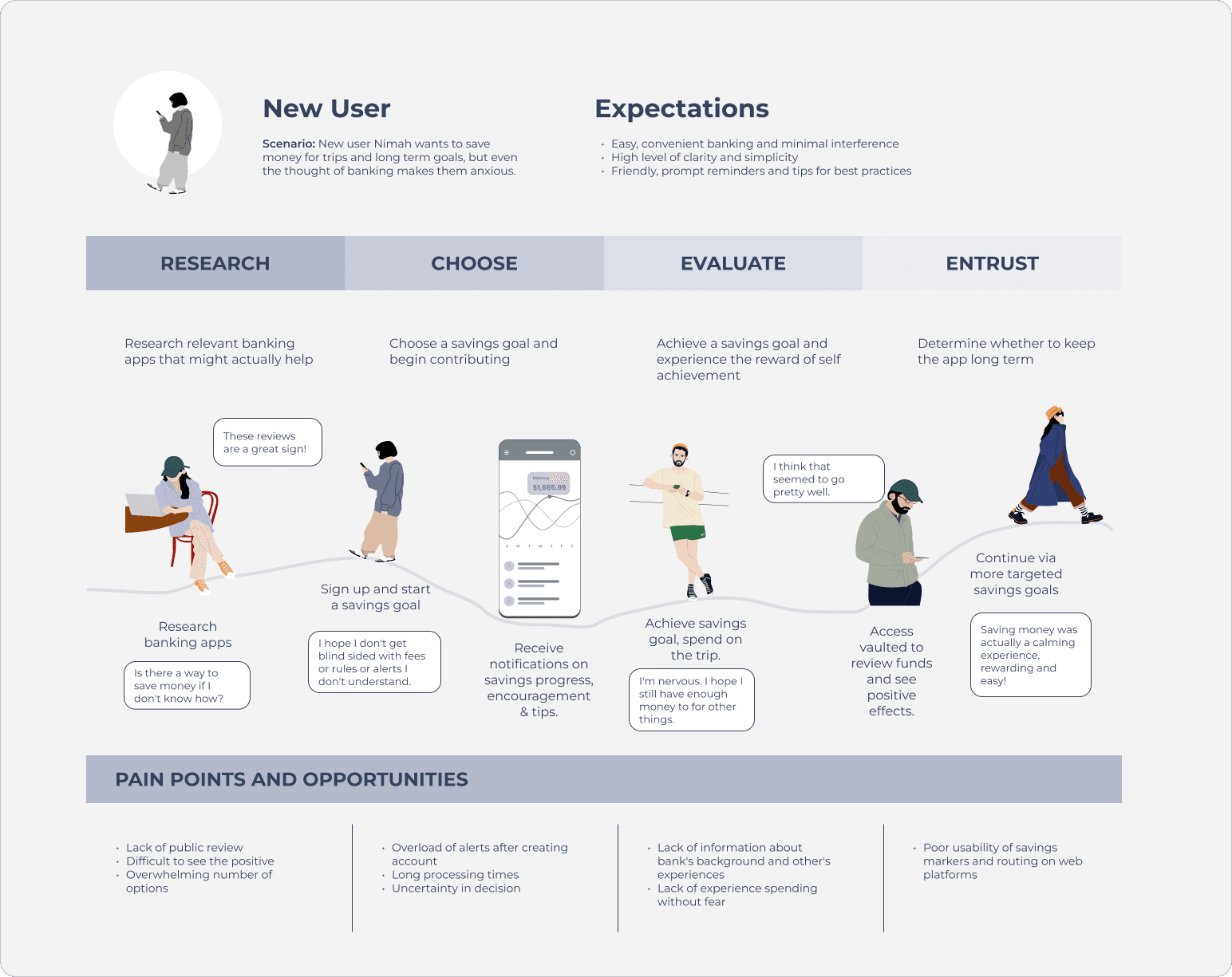

Creating a user journey brought the data to life and convinced the team we were heading in the right direction.

I intentionally created a singular, genderless person who embodied the key traits of of a neurodivergent user interested in saving for specific goals, with their emotions and pain points at each step in the journey of using the app to achieve savings goals. Storyboarding this scenario helped bridge perspectives across developers and business stakeholders, as we openly discussed the pain points in the story and ideated potential solutions.

KEY USER FLOW DESIGN

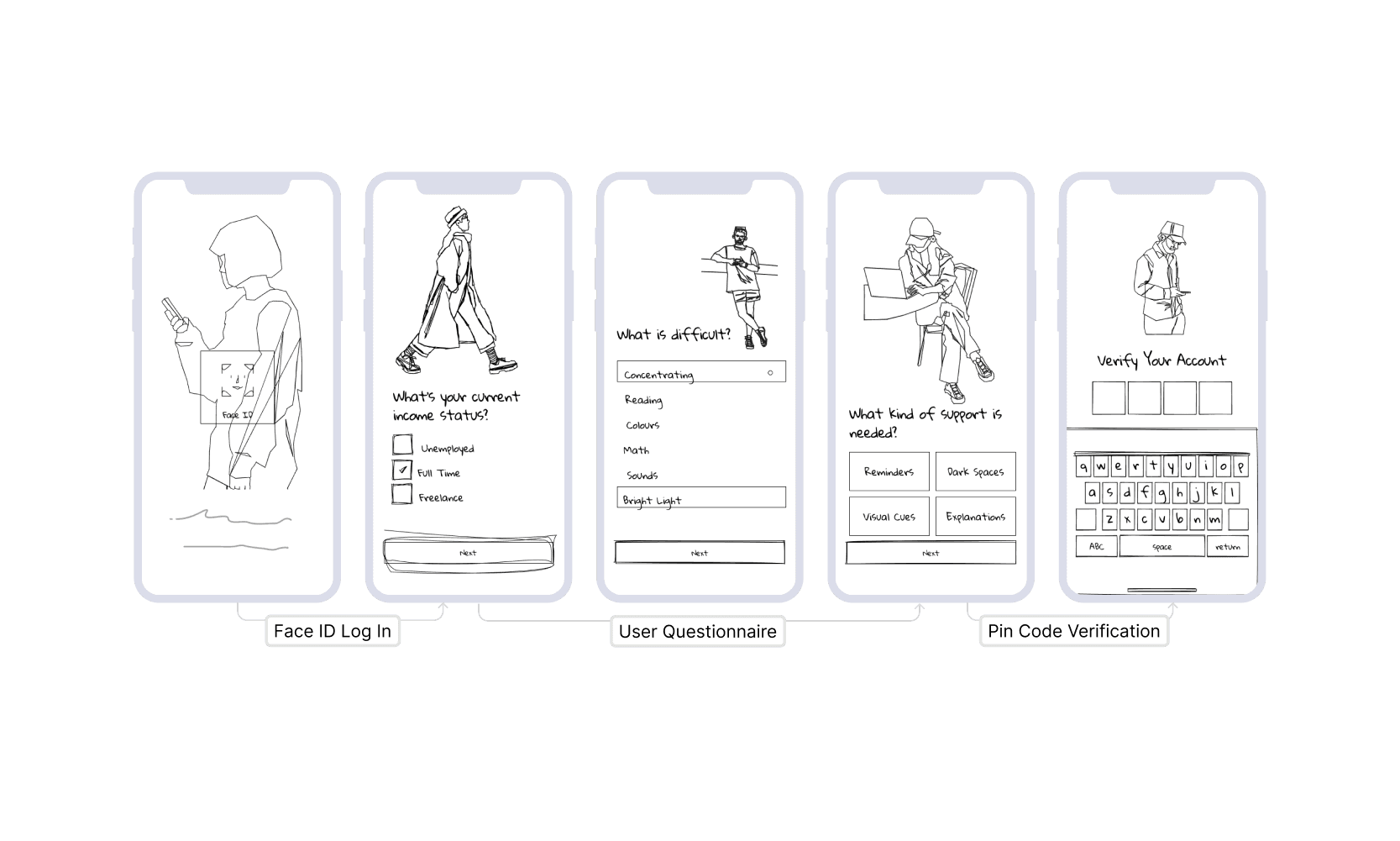

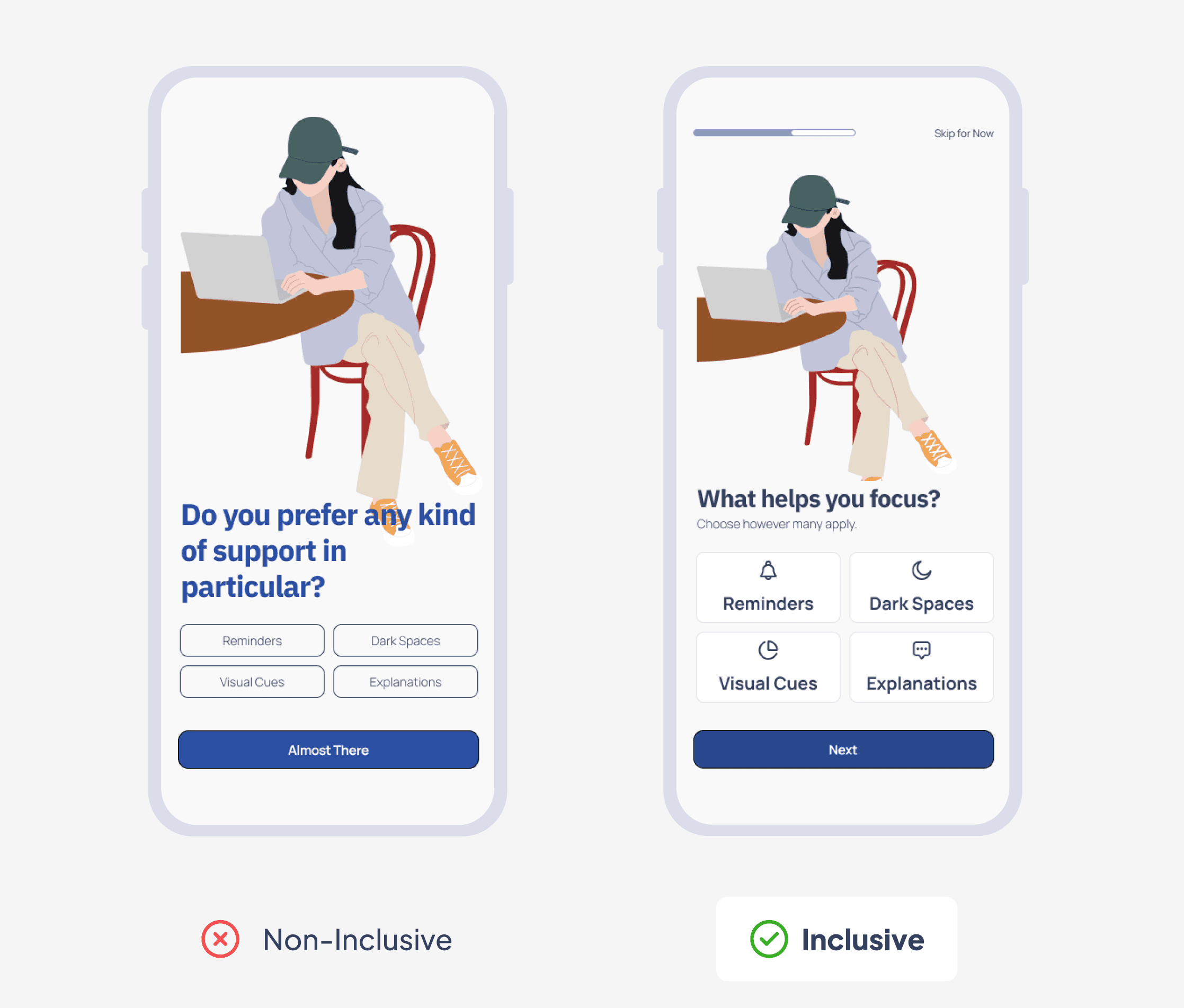

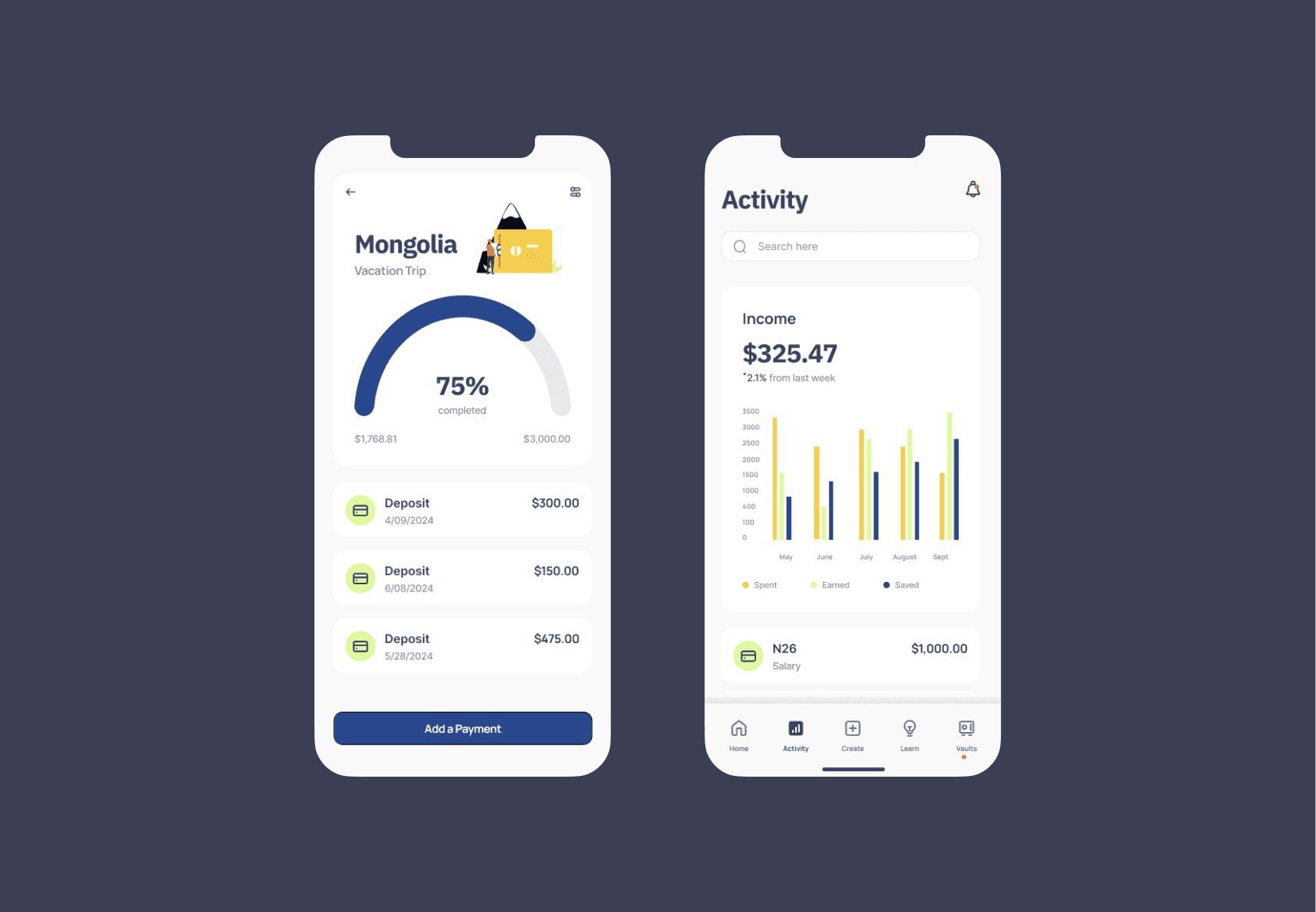

Based on my successful pitch, I was given the go-ahead to experiment with a personalised onboarding flow that addressed neurodivergent needs.

The flow was designed to meet the needs of a user who has a short attention span and regularly deviates from the task at hand, and adjust to their preferences. By designing meaningful onboarding questions with non-invasive transitions, I drove comprehension and improved engagement rates for new users.

USABILITY TESTING

Rigorous research and testing brought us closer to a strong product.

I learned that while this approach took longer to complete, each iteration on these ideas with the team gave more focus to the user experience while balancing business objectives. My in-depth interviews and tests included a range of neurodivergent users to see how they fared through several tests.

TESTING RESULTS

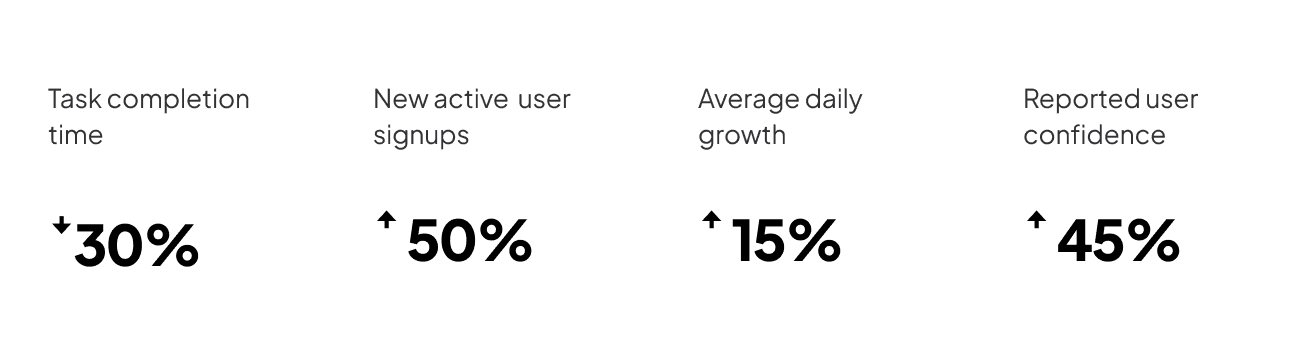

User engagement data significantly increased after designing for inclusivity, confirming the design improvements.

↳ Onboarding Completion (40% increase in successful signups)

↳ Goal & Notification Conversion (32% increase in achieving a savings goal)

↳ Achieving Customised Goals (45% reduction in errors)

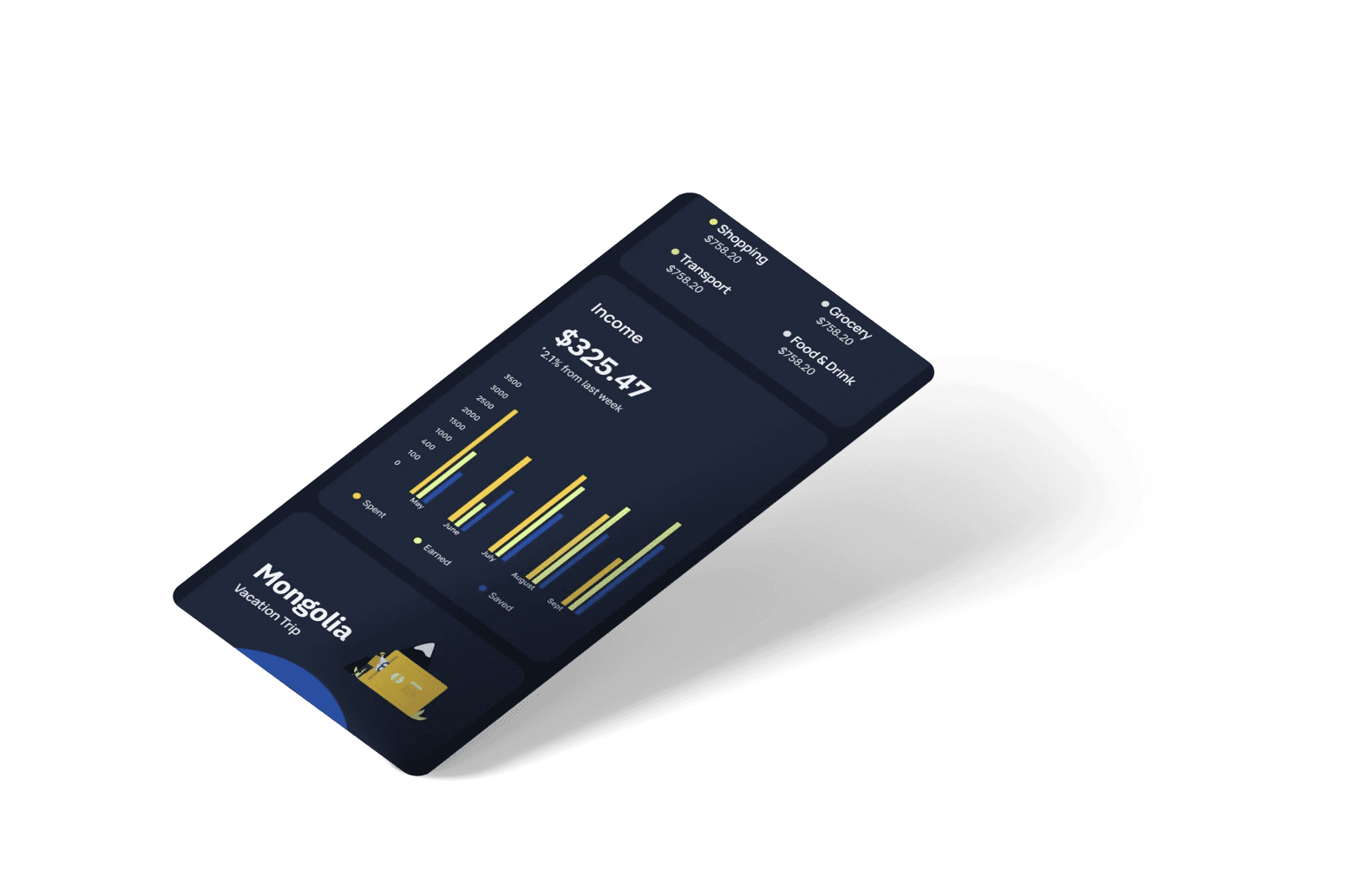

↳ Visual Accessibility (90% better performance in Dark Mode)

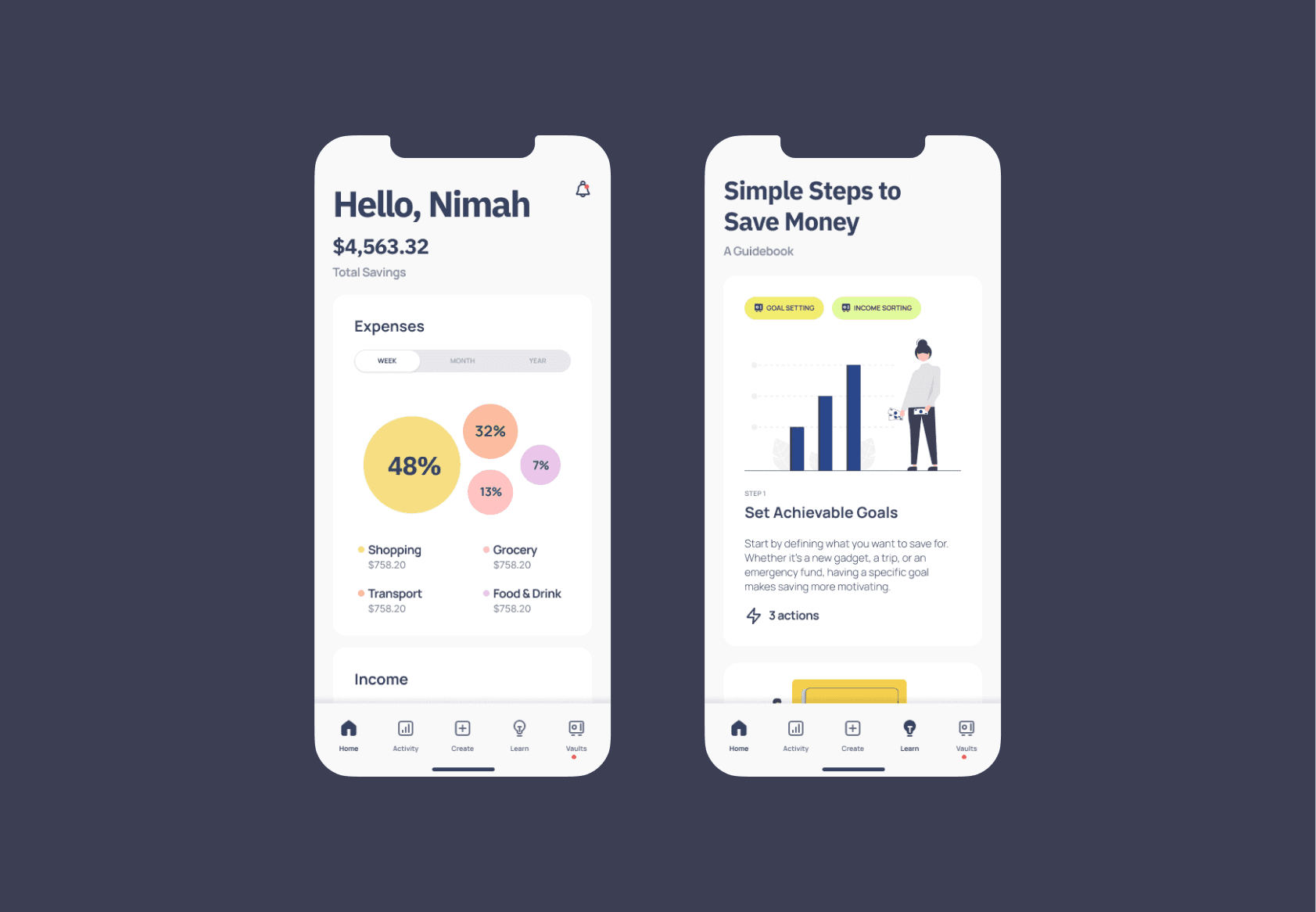

FINAL DESIGNS

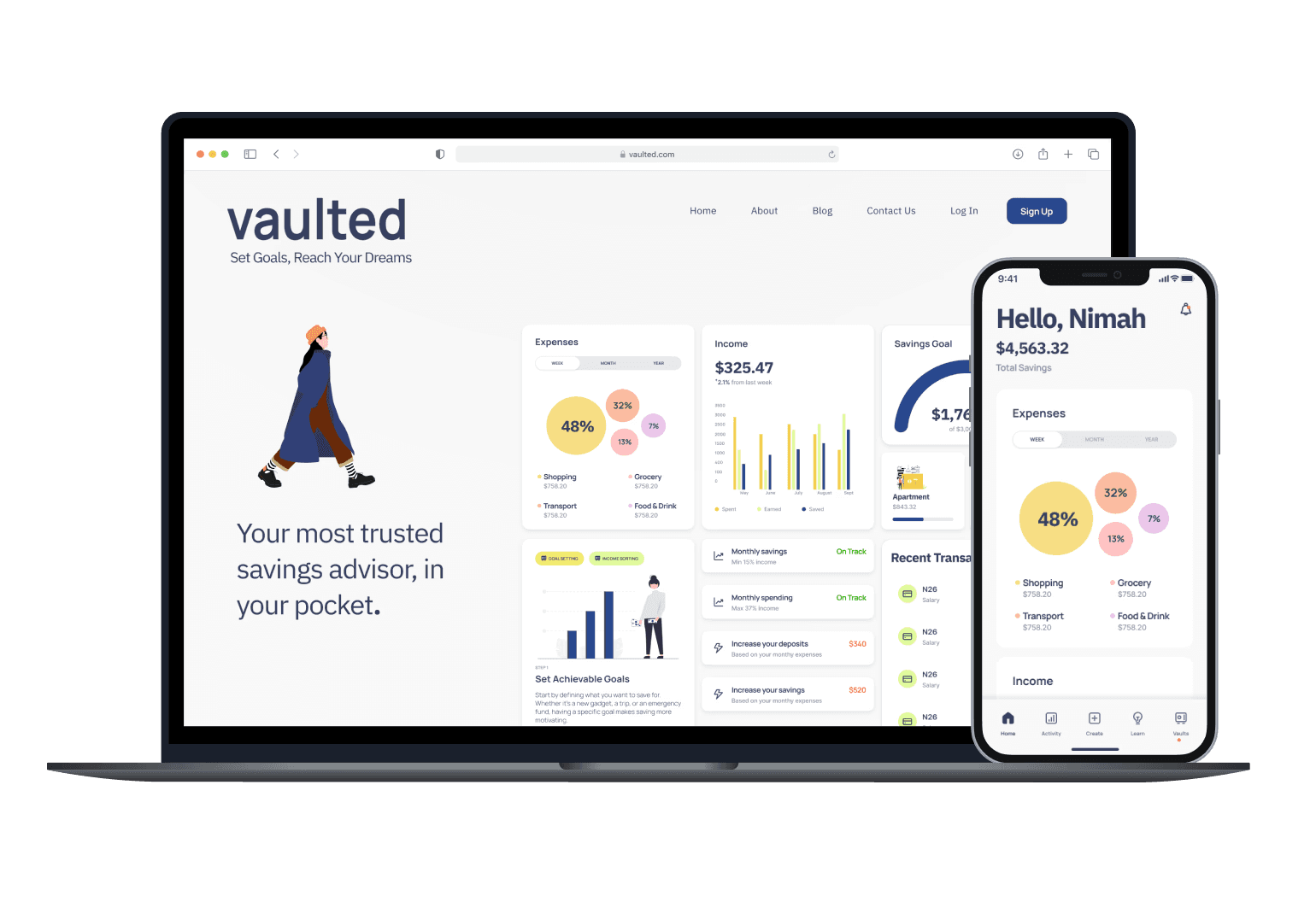

High-fidelity wireframes and interactive prototype facilitated a successful team pitch to investors.

After an in-depth regroup meeting with developers, the product manager and CEO, in which I presented my designs and answered questions, I submitted a handoff-ready set of high-fidelity wireframes with an interactive prototype and sold documentation of components for their design system.

Impacts

My designs achieved significant positive results, providing neurodivergent savers a clear, approachable tool to create savings goals and track spending habits, improving financial literacy and empowering users to make informed decisions about their finances. As a result, the application garnered high user satisfaction and engagement ratings. Further user testing and interviews could generate greater impact through enhanced features like an AI powered chat or tailored savings targets.